New Delhi: 9th May, 2022

As we celebrate the 7th anniversaries of three social security (Jan Suraksha) schemes, Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Atal Pension Yojana (APY), let us focus on how these schemes have provided affordable insurance and security to people (Jan Suraksha), their achievements and salient features.

PMJJBY, PMSBY and APY were launched by Prime Minister Shri Narendra Modi on 9th May, 2015 from Kolkata, West Bengal.

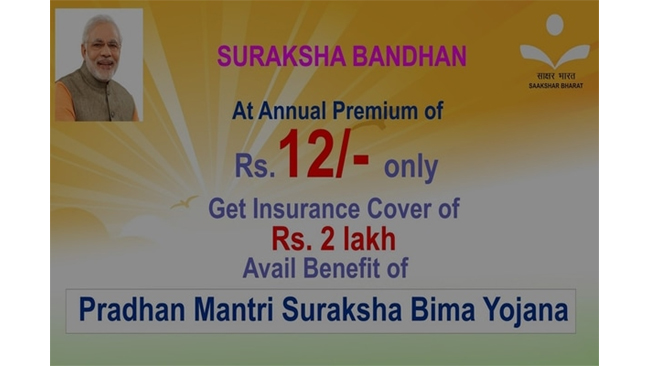

These three social security schemes are dedicated to the welfare of the citizens, recognising the need for securing human life from unforeseen risks/losses and financial uncertainties. In order to ensure that the people from the unorganised section of the country are financially secure, the Government launched two insurance schemes –Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY); and introduced Atal Pension Yojana (APY) to cover the exigencies in the old age.

While the PMJJBY and PMSBY provide access to low cost life/accidental insurance cover to the people, the APY provides an opportunity for saving in the present for getting a regular pension in old age.

While celebrating the 7th anniversary of the Scheme, Union Minister of Finance & Corporate Affairs Smt. Nirmala Sitharaman said, “One of the main objectives under the National Mission for Financial Inclusion announced by the Hon’ble Prime Minister on August 15, 2014 was to expand the coverage of insurance and pension in order to provide the poor and marginalised sections of the society the much-needed financial security through affordable products.”

“The three Jan Suraksha schemes have brought the insurance and pension within the reach of the common man. The number of people who have enrolled and benefitted from the above schemes over the last seven years is a testimony to their success. These low-cost insurance schemes and the guaranteed pension scheme are ensuring that financial security, which was available to a select few earlier, is now reaching the last person of the society,” the Finance Minister said.

Giving an overview of providing facilities to the poor, the Finance Minister said, “Today, even the poorest of the poor can have a life insurance cover for Rs 2 lakh at less than 1 rupee a day under PMJJBY and an accident insurance of Rs 2 lakh at less than 1 rupee a month under PMSBY. All the citizens of the country in the age group 18 to 40 can subscribe for receiving pension after the age of 60 by paying a minimum amount of Rs 42 per month.”

Providing security with convenience to citizens through PMJJBY, especially during COVID-19 Pandemic, Smt. Sitharaman said, “Under PMJJBY, a cumulative number of 12.76 crore persons have enrolled since inception for life cover and families of 5,76,121 persons have received claims for Rs. 11,522 crore under the scheme. The scheme has proved extremely useful for low-income households during pandemic as in FY21, almost 50% claims paid out were due to COVID-19 deaths. Major changes were brought in the claim settlement process for quick and easy settlement of claims during the pandemic period. These changes brought in for easy settlement of claims are still continuing. Since the beginning of the pandemic i.e., April 1, 2020 till February 23, 2022, a total of 2.10 lakh claims amounting to Rs 4,194.28 erore were paid with a settlement rate of 99.72%.”

The Finance Minister said that in a similar spirit, “28.37 crore people have enrolled for accident cover since the launch of PMSBY and an amount of Rs 1,930 crore has been paid towards 97,227 claims. More than 4 crore people have already subseribed to the APY scheme.”

On this occasion, Union Minister of State (MoS) for Finance Dr. Bhagwat Kishanrao Karad said, “On this 7th anniversary of these schemes, I congratulate all the banks and insurance companies for successful implementation of these schemes and request them to continue working with same zeal and dedication till the last person is covered.”

“Going ahead, as announced by the Hon’ble PM in this regard on his last Independence Day address, it will be our endeavour to ensure that every eligible person in the country is covered under these social security schemes for insurance and pension,” Dr Karad stated.