Jaipur,

October 8, 2020.

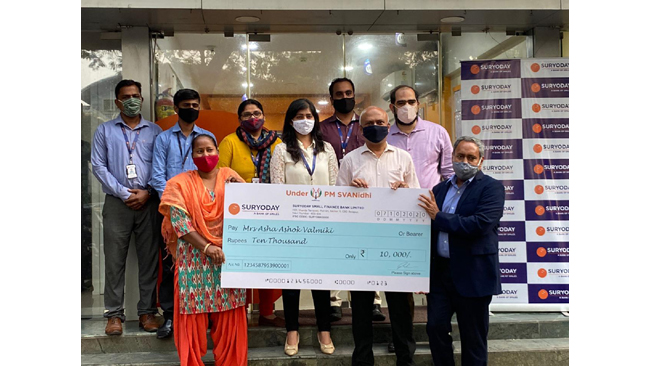

Suryoday Small Finance Bank (SSFB), one of the fastest-growing small finance banks today announced disbursement of its first loan under the PMs SVA Nidhi scheme .

The loan of Rs. 10000/- as mandated in the scheme was disbursed to “Mrs. Asha Ashok Valmiki, “ a vegetable vendor “. The Bank ensured that the complete process of sanctioning the loan and withdrawal was digital and hassle free.

Commenting on this R Baskar Babu , MD &CEO Suryoday Small Finance Bank said “ We take great pride in being a part of the PMs vision of providing small working capital loans to street vendors under the PM SVA Nidhi scheme , which is aimed at creating an Atmanirbhar ecosystem and helping them to bounce back after the crisis caused by the pandemic “ .

It is our endeavor always, to bring a world class banking experience to our customers and enable them to attain comprehensive financial stability. The government has been forthcoming in announcing various initiatives to the people and businesses most affected by the ongoing pandemic and we are delighted to be a part of this in our own small way.”

Suryoday Small Finance Bank since inception has been continuously developing and evolving the financial products and service to make it more holistic to serve the needs of the under banked segment, apart from financially educating them about various saving and investment options, government insurance schemes and digital banking channels.

Suryoday Small Finance bank (SSFB) is positioned well both in terms of assets and liabilities. Currently SSFB has a deposit base of approx Rs 3000 crs in deposit book and a gross loan portfolio of around 3700 crs.

SSFB offers one of the most competitive deposit rates in the industry. Currently, a savings account can get an interest rate of up to 6.25%, whereas for an FD, the customer can earn up to 7.50% interest rate. For senior citizens, the interest rate offered is 8%