In 2019 the slowdown in the Indian economy affected all sectors including BFSI. According to an RBI report, year-on-year non-food bank credit growth decelerated to 7.2% in November 2019 from 13.8% in November 2018. The impact of this slowdown was felt across the Fintech sector, and BankBazaar like the rest, started FY20 on a tough note. However, it bucked the trend from the start of Q3, growing consistently for 4 successive months, and eventually delivered a 46% increase in revenue and 17% reduction in costs. The company is now on track, both in terms of revenue and visitors, and is set to close March 2020 on a month-on-month EBITDA profitable basis.

Speaking on the growth, Adhil Shetty, Co-founder and CEO, BankBazaar, said, “As a company, BankBazaar has been focused on building great paperless consumer experiences and business profitability. This vision held us in good stead when we started off the year in a difficult market situation. We knew that a fully digital experience delivered via free credit score and instant paperless checkout was a winning formula for this downturn market. We leveraged our technology to optimize the experience for our customers and partners, making us an indispensable part of the product purchase process. This year we’ve been very careful about how we allocate resources, and as a result, we have made strides in controlling our costs and increasing revenue to grow profitably for the long run.”

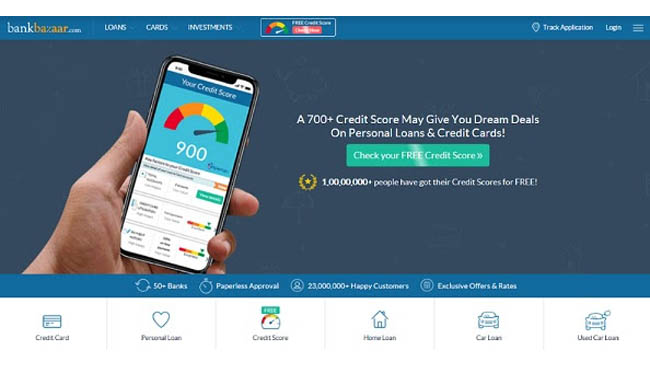

According to BankBazaar, as a Fintech, its paperless technology gives it a huge edge, not just in terms of the product but also in driving organic growth. Through the implementation of Machine Learning, the platform is able to connect its registered customers with the right financial products within minutes. This simplifies the financial product purchase journey and leads to an increasing number of returning customers. This, in turn, brings down the cost of customer acquisition and has helped BankBazaar accelerate its way to profitability. Adds Shetty, “Paperless technology is a game changer for India and key to the democratization of finance as it drastically cuts costs of operations and increases speed of delivery of the smallest financial product to the remotest part of India.”