Bengaluru, 11th December, 2020.

Amazon,Ajio, Dmart, Zomato, Udaan, Xiaomi

and BigBasket have emerged as the leaders in the newly launched

RedSeerShadowfax Leadership Index (RSLI) report which provides a definitive

view of the eCommerce sector’s quarterly performance on supply chain and

logistics and indices them across parameters of growth, performance,

efficiency, customer and merchant experience. The eCommerce sectors covered in

the RSLI include horizontal, vertical, omni-channel, direct-consumer,

hyperlocal (FoodTech, eGrocery etc.) and eB2B.

In the horizontal retailers’ segment, Amazon led the segment but both Amazon and Flipkart were fairly close on all the parameters. However, Meesho stood out in terms of growth and reverse shipment experience.

AJIO led in the vertical segment while DMart led in the omnichannel space. Xiaomi led in the D2C segment, while BigBasket led in the eGrocery (Hyperlocal) segment, Zomato led the foodtech (hyperlocal) segment and Udaan in the eB2B space.

Methodology

The RedSeerShadowfax Logistics Index is built on a framework of four pillars which is further measured on 15 metrics. The four pillars are growth index, performance and efficiency index, merchant experience index

and customer experience index. The study’s methodology took a multi-pronged approach towards building the index which includes expert interactions, customer surveys, competitive intelligence among others followed by data analysis. The scores on a standard scale of 0-100 at parameter level were then multiplied with the weightages to arrive at the final index score.

Introduction to Indices:

● Growth Index: eCommerce horizontals dominated in growth during the quarter. The sector saw 100%+ growth due to COVID recovery and pent-up demand.

● Performance Index: Omnichannel retailers dominated in performance and efficiency due to their low cost of fulfilment. Their turn-around time for delivery is also lower as they are also able to fulfil the orders from local stores. Hyperlocal brands and vertical platforms had high costs of fulfilment.

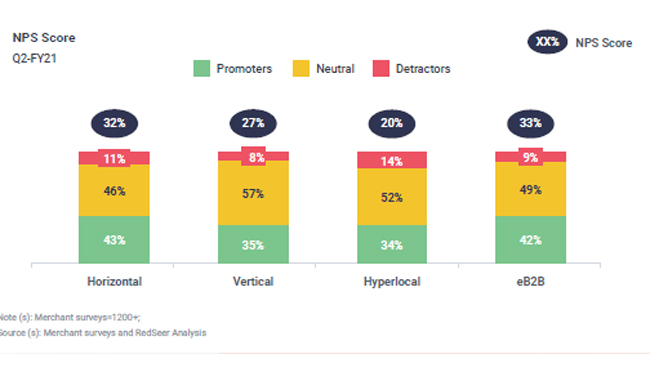

● Customer Experience Index: Horizontal and vertical sectors led in customer experience across logistics parameters reflecting in their higher NPS. eB2B lagged in customer experience due to lower customer satisfaction on ease of shipment returns and lower NPS.

● Merchant Customer Index: eB2B platforms have high merchant satisfaction as they have enabled significant reach for the merchants, resulting in higher NPS.

Commenting on the launch, Abhishek Bansal, Co-founder and CEO, Shadowfax said, “Logistics is emerging as the bellwether sector indicating the economic recovery and fiscal wellbeing of India. The pandemic, while it has presented a multitude of challenges, has also presented an unprecedented opportunity for the sector. Many critical sectors including e-commerce and retail are staging a recovery, owing to the innovation in logistics. At Shadowfax, our proprietary API enables and empowers our partners to manage their logistics requirements efficiently and effectively. We strongly believe that speed and criticality at doorstep would drive the next revolution in eCommerce logistics. Both these factors play heavily into the customer’s decision making, platform stickiness and an enhanced customer experience. To further iterate the crucial role logistics plays in empowering enterprise, we are launching the RedSeerShadowfax Logistics Index. This one of a kind index will objectively capture emerging trends in the logistics sector and provide insights that will drive innovation shaping the future of the e-commerce logistics industry.

“We are excited to partner with RedSeer for the launch of the index as they bring unmatched experience and expertise in the domain. Through our association, we aim to unlock new opportunities in the Indian e-commerce logistics market and provide a comprehensive analysis of sector defining trends. The index will help uncover opportunity areas that will go a long way in propelling the logistics sector to a higher growth trajectory," he further added.

Commenting on the launch of the report, Anil Kumar, Co-Founder and CEO of RedSeer Consulting said, “The RSLI report dives to provide an exhaustive understanding of the sector. This is the first time that such a comprehensive study has been undertaken and so many fragments have been looked upon to give an overview of the logistics sector.

Logistics has been one of the key reasons for the success of e-commerce in India. This study will help the ecosystem get a more nuanced understanding of the key success levers for ecommerce logistics and how it varies across various ecommerce sectors. In the report, we have also identified emerging trends in the logistics space along with the key ecommerce leaders who are leading on growth, efficiency and customer experience.”

He further adds that with both RedSeer and Shadowfax capabilities, the joint study identifies the trends and the scope in the logistics sector and, more importantly, looks into areas where the sectors and players can perform better.

Insights from Sectors and Players:

Horizontal players scored highest in the growth and scale index followed by D2C, hyperlocal then vertical. However, customer satisfaction on logistics experience has been highest by vertical platforms, followed by

horizontal, omnichannel, hyperlocal, D2C and eRTM, and eB2B. But, eB2B as a sector overall, also witnessed very good seller satisfaction as most of the sellers were using the platform for the first time.

The report cites that one of the reasons for higher customer and merchant satisfaction for horizontal and vertical sectors is due to their ability to leverage their captive logistics and extensive usage of the capabilities of new age diversified third party logistics.

Overall Shipments Growth

eCommerce platforms shipped ~2.5 billion shipments in

FY2020 growing at ~50%+ CAGR in the last 3 years. However, the report cites

that shipment volume is expected to grow at ~30-35% CAGR for next

5 years.

Some of the key drivers of growth for eCommerce are the latent demand in Tier-2+ cities, enablement of logistics networks, infrastructure built by eCommerce platforms (large horizontals), and new age third-party logistics players in the last 3-4 years.