Mumbai, August 2025.

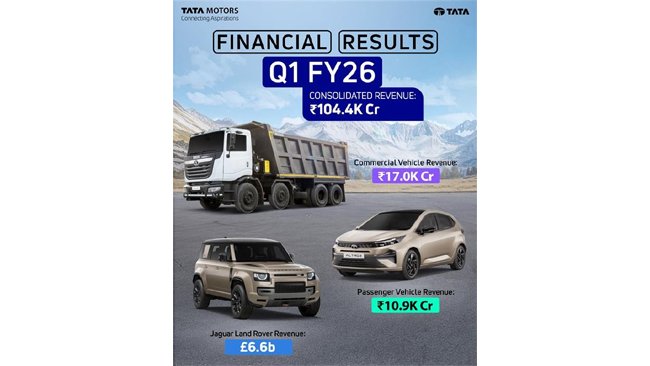

Tata Motors Ltd.(TML) announced its results for quarter ending June 30, 2025.

|

Q1FY26 |

|

Consolidated (₹ Cr Ind AS) |

Jaguar Land Rover (£m, IFRS) |

Tata Commercial Vehicles (₹Cr, Ind AS) |

Tata Passenger Vehicles (₹Cr, Ind AS) |

||||||

|

|

FY25 |

Vs. PY |

FY25 |

Vs. PY |

FY25 |

Vs. PY |

FY25 |

Vs. PY |

|||

|

Revenue |

104,407 |

(2.5)% |

6,604 |

(9.2)% |

17,009 |

(4.7)% |

10,877 |

(8.2)% |

|||

|

EBITDA

(%) |

9.2 |

(480) bps |

9.3 |

(650) bps |

12.2 |

60 bps |

4.0 |

(180) bps |

|||

|

EBIT (%) |

4.3 |

(370) bps |

4.0 |

(490) bps |

9.7 |

80 bps |

(2.8) |

(310) bps |

|||

|

PBT

(bei) |

5,617 |

₹(3,232)

Cr |

351 |

£(342)m |

1,657 |

₹122Cr |

(129) |

₹(302)Cr |

|||

Tata Motors Consolidated:

TML performance in the

quarter was impacted by volume decline in all businesses and a drop in

profitability primarily at JLR. Revenues at ₹104.4K Cr (down 2.5%), EBIT of ₹4.5KCr(-₹4.1KCr),

EBIT margin of 4.3% (-370bps).JLR revenues were down by 9.2% to £6.6bwithEBIT

margins of 4.0% (-490bps)affectedby US trade tariff impact. CV revenues were downby 4.7% to ₹17.0K Cr,while EBITDA margins improved to 12.2% (+60 bps) benefiting from better

realizations and cost savings despite lower volumes. PV revenues declined by

8.2% reflecting softness in industry demand, and transition to new models. As a

result, EBITDA at 4.0% down by 180bps.Despite these challenges the consolidated

PBT(bei) was ₹5.6KCr benefiting from the sharp reduction in finance costs.

Corporate actions:

I. The final hearing for the scheme of demerger has

been concluded today by NCLT and order is reserved; we aim to complete it this

quarter with 01st October being the Effective Date

II. On 30 July 2025, TML announced the 100% acquisition

of Iveco Group N.V. (excluding Defence) shares via Voluntary Tender Offer to

all public shareholders bringing together complementary capabilities, global

reach, and a shared strategic vision to drive long-term growth and unlock

significant value. The Offer, valued Eur 3.8bn, is subject to obtaining the

required clearances, and is expected to complete in the first half of 2026.

Looking Ahead:

With the demand situation likely to remain challenging, we will continue

to focus on strengthening the business fundamentals and mitigate the impact of

tariffs by leveraging the brand strength to drive a better mix, and targeted

actions to improve contribution margins.

PB Balaji, Group Chief Financial Officer, Tata

Motors said:

“Despite stiff macro

headwinds, the business delivered a profitable quarter, supported by strong

fundamentals. As tariff clarity emerges and festive demand picks up, we are aiming

to accelerate performance and rebuild momentumacross the portfolio. Against the

backdrop of the upcoming demerger in October 2025, our focus remains firmly on

delivering a strong second-half performance.”

|

JAGUAR

LAND ROVER (JLR) |

·

JLR delivers 11th

successive profitable quarter amid challenging global economic conditions

·

Q1FY26 Revenue at £6.6billion (-9.2%) impacted by significant new

US trade tariffs and planned legacy Jaguar wind down; EBITDA 9.3% (-650 bps)

·

PBT was£351million for Q1 ,down 49.4%

YoY, impacted by US tariffs and FX headwinds

·

EBIT margin was 4.0%; guidance range of 5% to 7% for FY26 remains

unchanged

·

Free cash flow for the quarter was £(758) million, with a cash

balance of £3.3 billion

·

Total liquidity was £5.0 billion, including the £1.7 billion undrawn

revolving credit facility

·

Welcomed signing of UK-US trade deal to reduce tariffs on

UK-produced vehicles exported to the US from 27.5% to 10%, effective from 30

June 2025

·

EU-US trade deal announced on 27 July 2025 will, in due course,

reduce tariffs on JLR’s EU-produced vehicles exported to US from 27.5% to 15%

Reimagine Transformation

continues

Modern Luxury

·

RR Electric prototypes driven for first time

by media to critical acclaim, as waiting list surpasses 65,000

·

RR SV Masāra&SV Saturio launched in India

& Mexico respectively, with global launches of RR, RR Sport SV Black models

·

Defender launches OCTA Black Edition, Defender

Trophy competition &related Trophy Edition; Defender appointed official

global automotive partner of Oasis Live ’25

·

Discovery launched Tempest & Gemini

Editions; Landmark and Metropolitan Editions introduced for Discovery Sport

·

Jaguar Type 00 debuted at Goodwood (UK), Tokyo

and Monaco, following reveals in Paris and Miami

·

JLR affirms longstanding association with

British Royal Family with grant of Queen’s Royal Warrant

Electrification /

Sustainability

·

JLR delivers over £100m of value from reuse

& refurbishment initiatives as it transforms its industrial operations for

electrification

·

EDU and battery lines nearing completion at

Electric Propulsion Manufacturing Centre, Wolverhampton UK, to produce electric

vehicle components for next-generation electric vehicle

Financials

JLR’s revenue for the quarter was £6.6 billion, down 9.2% vs Q1

FY25. Wholesale volumes &revenues in the quarter were impacted by the

application of 27.5% US trade tariffs on UK- and EU-produced cars exported to

the US, and the planned wind down of legacy Jaguar vehicles ahead of the launch

of new Jaguar. US trade tariffs also had a direct and material impact on

profitability and cash flow in the period.The US-UK trade deal will

significantly reduce the financial impact of US tariffs going forward.PBT in

the quarter was £351 million, down from £693 million a year ago with EBIT margin

at4.0%. The decrease in profitability YoYwas impacted by the introduction of US

tariffs and FX headwinds in the period.

Looking ahead

We remain focused

on delivering our Reimagine Strategy and expect investment spend to remain at

£18 billion over the five-year period starting in 2024, funded by operating cash

flows. Guidance for FY26 remains unchanged, with EBIT margin in the range of 5%

to 7%, improving year-on-year for FY27 and FY28, and with FY26 free cash flow

close to zero.

Adrian Mardell,JLRChief Executive Officer,

said:

“Thanks to our talented people and the

robust foundations we have built at JLR, we delivered an 11th successive

profitable quarter amid challenging global economic conditions. We are grateful

to the UK and US Governments for delivering at speed the new UK-US trade deal,

which will lessen the significant US tariff impact in subsequent quarters, as

will, in due course, the EU-US trade deal announced on 27 July 2025.Looking

ahead, we remain focused on delivering our transformational Reimagine Strategy,

including investing £3.8 billion this financial year to support the development

of our next-generation vehicles, including our stunning new electric Range

Rover and Jaguar models.”

|

TATA

COMMERCIAL VEHICLES(TATA CV) |

Highlights

·

Q1 FY26revenue at ₹ 17.0KCr

(-4.7%), EBITDA 12.2% (+60 bps), EBIT 9.7% (+80 bps), PBT (bei) ₹1.7K Cr

·

ROCE at 39.6% (37.7%

in FY25)

·

CV segmentwholesales

at 88.0K units (-6.0%). Domestic volumes were down by 9% YoY, exports were up

by 68%

· Domestic CV VAHAN market share at 36.1% in Q1 FY26.HGV+HMV 47.7%, MGV 35.9%,

LGV 28.9%, Passenger 36.9%.

·

Launched Ace Pro:

India’s Most Affordable 4-Wheel Mini-Truck, heralding a new era in cargo

mobility to empower India’s next wave of entrepreneurs

·

Launched air conditioned

cabins and cowls across Truck range, setting new benchmarks with smart upgrades

designed to improve real-world performance

·

Strengthened presence

in Qatar with the launch of all-new LPO 1622 bus

Financials

Q1 FY26 beganonsubdued note for the commercial vehicle

industry with muted performance in the HCV and SCVPU segmentswhile Buses, Vans,

and ILMCVs registered modest YoY growth.Domestic volumes were down by 9% while

exports were up by 68%. Revenues were down by 4.7% to ₹ 17.0K Cr. The business

continued to witness double digit EBITDA margins of 12.2% and EBIT margins of

9.7% in Q1 FY26,lead by better realizations and material cost savings and

reported strong PBT(bei) of ₹ 1.7K Cr.

Looking ahead

With

forecasts for a healthy monsoon across the country, reduction in repo rate and

renewing thrust on infrastructure development, we expect volumes to improve

progressively in the coming quarters. We remain focused on driving our

demand-pull strategy and deepening customer engagement to deliver greater value

and tailored solutions that help our customers grow their business. The business will

continue to focus ondoubledigit EBITDA delivery, higher ROCE and improve Vahan

market shares in all segments by focusing on customer value proposition.

Girish

Wagh, Executive Director Tata Motors Ltd said:

“Q1 FY26 was a challenging quarter for the commercial

vehicle industry, with subdued demand across key segments impacting overall

performance. We also witnessed a decline in domestic sales volumes, reflecting

broader market softness and delayed fleet replacement cycles, while segments

like Buses and Vans showed resilience and our International Business delivered

growth.Our commitment to product innovation and customer-centricity remained

strong. The launch of the Ace Pro mini-truck in multiple powertrain options

received encouraging initial market response, reaffirming our focus on

delivering relevant and affordable mobility solutions. Despite adverse volumes,

the business delivered 12.2% EBITDA and healthy ROCE of ~40%.

Theacquisition of IVECOGroup is a strategic leap forward

in our ambition to build a future-ready commercial vehicle ecosystem. By

integrating the strengths of both organizations, we will be unlocking new

avenues for operational excellence, product innovation and customer-centric

solutions.”

|

TATA PASSENGER VEHICLES (TATA PV) |

Highlights

· Q1 FY26 revenue at ₹ 10.9KCr, (-8.2%), EBITDA 4.0%

(-180 bps), EBIT -2.8% (-310bps), PBT (bei) -₹0.1K Cr

·

PV wholesales at 124.8K

units (-10.1%). EV wholesalesat 16.2K units (-2.1%)

·

EV penetration steady

at 13%.CNG penetration at 27% in Q1 FY26

·

VAHAN registration

market share at 12.3% in Q1 FY26. EV marketshare at 36.7%

·

Delete—Impossible

Harrier.ev unleashes a Bold New League of SUVs, 10,000 bookings on day 1

·

Launched the All-New

Altroz – Premium by Legacy, Modern by Design

·

Introduced Lifetime

HV Battery Warranty for Curvv.ev and Nexon.ev 45 kWh

·

Tata Punch becomes

India’s Fastest SUV to cross 6 lakh milestone in under 4 years

Financials

PV industryin Q1 FY26, experienced volume pressures,

particularly in May and June, with flat growth reflecting continued softness in

demand. In Q1 FY26, wholesale volumes stood at 124.8K units (-10.1%), on

account of industry decline & transitions for new models ofAltroz, Harrier

& Safari, even as we continued to ensure controlled channel inventory

growth. Revenues stood at ₹ 10.9K Cr (-8.2%)on account of drop in volumes.EBITDA

margin was down by180 bps YoY at 4.0% whileEBIT margins declined by 310 bps YoY

to (2.8)%.PBT(bei) was at ₹(129)Cr.Profitability was impacted as a result of

adverse volumes, realizations and impact of leverage, but was offset in part by

our continued drive on savings in variable costs.

Looking ahead

We have witnessed

tailwinds towards the end of Q1 – Tiago and Altroz have seen 22% increase in

bookings in June 25, while Harrier.ev launch has been extremely well received. Curated

variants of Harrier & Safari have been launched at competitive price points.

July month recorded highest-ever monthly EV sales, a significant milestone in

the zero-emission journey.Thus, while overall industry growth is expected to

remain subdued, Tata Motors is well positioned to leverage its new

launches—including hatchbacks and SUVs, while continuing to build on the EV

momentum. We continue our focus to improve profitability through key levers

like aftersales transformation, leveraging technology and structural cost reduction.

Shailesh Chandra, Managing

Director TMPV and TPEM said:

“Q1 FY26 was a

subdued quarter for the passenger vehicle industry, with volume pressures

persisting across most segments. Demand softness weighed on overall

performance, although the Electric Vehicle category remained a bright spot,

supported by new launches and growing customer interest.Our continued focus on

customer engagement and portfolio renewal remained strong during the quarter.

New launches—Altroz and Harrier.ev—received encouraging initial market

response, with their full impact expected to unfold in the coming

months.Looking ahead, while the overall industry growth is expected to remain

muted, we are confident that our recent and forthcoming series of

launches—across ICE and EVs—will enable us to outperform the market and

strengthen our position across key segments.”