Gurugram, December

2023.

There is a

decline across smart devices among consumers in India. This was revealed

in ‘India Connected Consumers Report 2024’ 4th edition of the

report released by Techarc today. Every year, Techarc releases insights

and trends about connected consumers in India with regards to their adoption

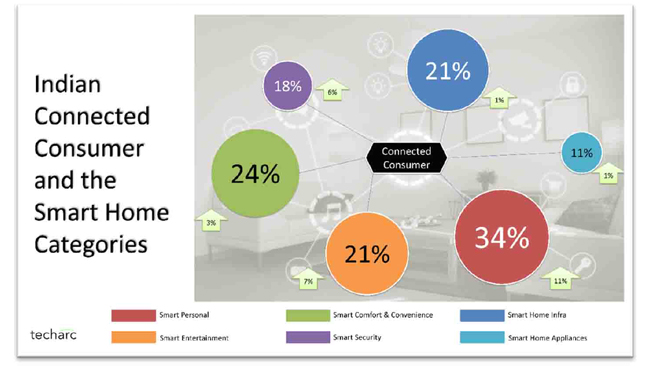

and preferences for various smart devices. The devices are categorised

as:

- Smart

Personal – Laptops including Chromebooks, Tablet PCs, Wearables.

- Smart

Entertainment – Smart TV, Streaming Devices, Smart Speakers.

- Smart

Comfort and Convenience – Smart Lights, Smart Switch, Smart Air Purifier,

Smart AC, Smart Water Purifier, Smart Heater.

- Smart

Home Infra – Router, Thermostat, IR Blaster.

- Smart

Security – Smart Surveillance Camera, Smart Door Lock, Smart Video

Doorbell.

- Smart

Home Appliances – Smart Washing Machine, Smart Vacuum Cleaner, Smart Air

Fryer, Smart Oven.

The insights and

trends are basis survey among 2,500 connected users in India, secondary data

and analysis of reviews and ratings of over 400 SKUs of such smart devices sold

over ecommerce marketplaces.

Sharing the key

takeaways of the report, Faisal Kawoosa, Chief Analyst and Founder Techarc said,

“What is worrying to witness is that the interest of consumers is declining in

these smart devices as they fail to deliver real value to them beyond a

point. There is need to add significant value in these devices to get

consumers excited furthering the growth of the overall market. We are already

seeing smartphone market stagnating. In other smart devices we have scope

if we improve the value quotient for consumers.”

“Chipset is going to

play a critical role in bringing this value as it defines the capabilities and

functions of any device that it powers. In the smart devices also, it is

important that OEMs start taking the selection of chipset as a critical

decision and collaborate with technology enablers to create value and

delightful experiences,” added Faisal.

Report Key takeaways

Smart Devices

- Overall,

the adoption of smart devices is increasing, but the year-on-year increase

is incremental that will not only shrink the growth but also stress

profitability and eventually wipe off some OEMs consolidating the market.

- The

consumer electronics category, that is defined under Smart Comfort and

Convenience isn’t seeing the adoption to the potential. Even the

consumers who go for smart option within these categories either never use

such feature or just buy it as a ‘nice to have’ feature.

- In

the Smart Personal category, Chromebooks see a dip in adoption compared to

previous year. This is owing to the fact that this affordable

alternative to personal computing isn’t emerging as convincing enough as

it could be. Further Tablet PCs are seeing better options within

Android with some OEMs like Xiaomi and OnePlus having expanded their

portfolio in 2023.

- Smart

TV is emerging as the most promising smart device. Every consumer,

at household level is potentially looking forward to buy a smart TV.

Just like mobile phones where almost every user aspires to own one, every

household is desiring owing a smart TV. After mobile phones,

Television is likely going to be the 2nd device which will

witness the smartisation wave.

- Except

for Smart Lights, no other Smart Comfort and Convenience device looks

promising to consumers. This category needs an overhaul in terms of

the value proposition.

- The

affordable and reliable options in smart camera are triggering further

growth in the category. Overall, the Smart Security category is

witnessing growth in adoption as security and surveillance remains a

priority.

- Smart

Home Appliances is another category which can’t convince the consumers

enough about owing one. The value addition needs to be significant

for consumers to consider these options.

- Except

for a router, which is a must to have a smart home, other Smart Home Infra

devices too are not seeing a great adoption. Though IR blaster did

see some good increase in 2024.

- The

decision making about selection of smart devices is increasingly taking

place on more information about the features and construct of these

devices. Consumers want to see the real value of these devices and

hence probe deeper about the features and functions as well as the

components that make them. This gives them a good view of what they

can expect about the performance and experience to derive the value.

- In

terms of chipset awareness, MediaTek has emerged as a leader.

Consumer awareness about chipset, and MediaTek as a chipset maker has

increased compared to previous year. Among the families of chipset,

consumer awareness about Dimensity portfolio has improved in 2024.

Other chipset makers also need to increase awareness about their brands and

the portfolio.

Report Key

takeaways Smart TV section

- The

future of Smart TVs will be driven by 3is of Immersive experience,

Intelligent features and Intuitive applications. This will require

more powerful processors that will also have emerging capabilities including

AI processing to create intuitive applications.

- In

terms of display size, the preference towards larger screen sizes (55-65

inches) is increasing among consumers. At the same time they

appreciate the value of audio and video enhancements, where Dolby has

established leadership in terms of awareness and use. 97% of the

smart TVs launched between Jan-Sep 2023, supported Dolby Atmos as a

feature.

- Android

OS is emerging as the default OS for Smart TV. 73% of launches

between Jan-Sep 2023 were powered by Google’s OS for Smart TVs.

- Consumers

are liking near naked eye resolutions. As a result, 2 out of 3

launches between Jan-Sept 2023 had 4K resolution in Smart TVs.

- MediaTek

powered the maximum number of Smart TV launches during Jan-Sep 2023.

32% of the Smart TVs launched had a MediaTek chipset.

Outlook for 2024

The OEMs of smart

devices along with technology enablers will need strong and deeper

collaboration in creating value and defining experiences for the connected

consumers to increase their excitement which is in return increase the sales of

these products. As the consumer journey evolves and matures further,

consumers will be exploring deeper into the value chain where they would want

to understand and learn more about the technologies and the component suppliers

powering these devices. One of the concerns consumers have in few

categories, like Smart TVs is that many OEMs do not reveal the component

manufacturers which doesn’t give them confidence about their quality and

reliability. Consumers want smart devices OEMs to be transparent like

smartphone OEMs who reveal their key component suppliers like chipset makers,

display suppliers, camera module manufacturers among others. This helps

the consumers evaluate the products with deeper understanding as well as

increase their confidence in them basis the independent reputation and

credibility of component makers.

The market for smart

devices is likely to register an overall modest growth rate of 10-13% by volume

and 15-18% by value in 2024 compared to the calendar year 2023. However,

if the OEMs are able to address the concerns of consumers and increase the

proposition value for them across these devices, the growth can further be

widened.